Mar 12, 2013

Starting a Company? 3 Things You Can't Mess Up (full story here)

Why do so many new ventures fail, even with so much money available? Because few start-up founders are clear-minded enough about three non-negotiable fundamentals:

1. Get the team right.

2. Find a profitable, sustainable market.

3. Get out of the start-up ecosystem.

1. Get the team right.

2. Find a profitable, sustainable market.

3. Get out of the start-up ecosystem.

Mar 11, 2013

Secret to becoming a resilient entrepreneur (full story here)

Could there be a more entrepreneurial activity than wrestling? What other sport forces you to step into the arena virtually naked, and rely only on your mind and body to make things happen? And just as it is with an entrepreneurial business, while knowledge and skills are always helpful, mental toughness and a will to win are at least as important.

Mar 9, 2013

Enrolled Agent Disbarred for Stealing a Client’s Tax Payments and Preparing Returns with False Deductions (full story here)

The Internal Revenue Service today announced that its Office of Professional Responsibility obtained the disbarment of enrolled agent Lorna M. Walker for stealing a client's tax payments and for preparing tax returns with false deductions for multiple clients.

Walker's enrolled agent status and her ability to prepare federal tax returns were revoked for at least five years. Walker practiced in the Seattle area.

Walker's enrolled agent status and her ability to prepare federal tax returns were revoked for at least five years. Walker practiced in the Seattle area.

Mar 8, 2013

Four Things You Should Know if You Barter (full story here)

Small businesses sometimes barter to get products or services they need. Bartering is the trading of one product or service for another. Usually there is no exchange of cash. An example of bartering is a plumber doing repair work for a dentist in exchange for dental services.

The IRS reminds all taxpayers that the fair market value of property or services received through a barter is taxable income. Both parties must report as income the value of the goods and services received in the exchange.

Here are four facts about bartering.

The IRS reminds all taxpayers that the fair market value of property or services received through a barter is taxable income. Both parties must report as income the value of the goods and services received in the exchange.

Here are four facts about bartering.

Mar 7, 2013

Ten Facts about Capital Gains and Losses (full story here)

The term “capital asset” for tax purposes applies to almost everything you own and use for personal or investment purposes. A capital gain or loss occurs when you sell a capital asset.

Read more here.

Read more here.

Mar 6, 2013

Seven Important Tax Facts about Medical and Dental Expenses (full story here)

If you paid for medical or dental expenses in 2012, you may be able to get a tax deduction for costs not covered by insurance. The IRS wants you to know these seven facts about claiming the medical and dental expense deduction.

- You must itemize.

- Deduction is limited.

- Expenses paid in 2012.

- Qualifying expenses.

- Costs to include.

- Travel is included.

- No double benefit.

Mar 5, 2013

Eight Tax Benefits for Parents (full story here)

Your children may help you qualify for valuable tax benefits, such as certain credits and deductions. If you are a parent, here are eight benefits you shouldn’t miss when filing taxes this year.

- Dependents.

- Child Tax Credit.

- Child and Dependent Care Credit.

- Earned Income Tax Credit.

- Adoption Credit.

- Higher education credits.

- Student loan interest.

- Self-employed health insurance deduction.

Mar 4, 2013

Six Important Facts about Dependents and Exemptions (full story here)

Some tax rules affect every person who may have to file a federal income tax return – these rules include dependents and exemptions. Here are six important facts the IRS wants you to know about dependents and exemptions that will help you file your 2010 tax return.

- Exemptions reduce your taxable income.

- Your spouse is never considered your dependent.

- Exemptions for dependents.

- If someone else claims you as a dependent, you may still be required to file your own tax return.

- If you are a dependent, you may not claim an exemption.

- Some people cannot be claimed as your dependent.

Mar 3, 2013

Ten tips to help you choose a tax preparer (full story here)

Many people look for help from professionals when it’s time to file their tax return. If you use a paid tax preparer to file your return this year, choose that preparer wisely.

Even if a return is prepared by someone else, the taxpayer is legally responsible for what’s on it. So, it’s very important to choose your tax preparer carefully.

Here are ten tips to keep in mind when choosing a tax return preparer: click here.

Even if a return is prepared by someone else, the taxpayer is legally responsible for what’s on it. So, it’s very important to choose your tax preparer carefully.

Here are ten tips to keep in mind when choosing a tax return preparer: click here.

Mar 2, 2013

Social Security Benefits and Your Taxes (full story here)

Some people must pay taxes on their Social Security benefits.

If you get Social Security, you should receive a Form SSA-1099, Social Security Benefit Statement, by early February.

The form shows the amount of benefits you received in 2012.

For more information on the taxability of Social Security benefits, see IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits.

If you get Social Security, you should receive a Form SSA-1099, Social Security Benefit Statement, by early February.

The form shows the amount of benefits you received in 2012.

For more information on the taxability of Social Security benefits, see IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits.

Mar 1, 2013

Michigan will take over Detroit (full story here)

The other shoe has dropped: the Detroit city government will be forced to cede its authority to an emergency manager chosen by Michigan Governor Rick Snyder.

"I believe it's important to declare the city of Detroit in financial emergency," Snyder announced at a midday press conference on Friday, in front of the banner, "Detroit Can't Wait." The EM will assume the suspended powers of the mayor and city council, and will take unilateral control of municipal finances, union contracts, pension systems, and more.

"I believe it's important to declare the city of Detroit in financial emergency," Snyder announced at a midday press conference on Friday, in front of the banner, "Detroit Can't Wait." The EM will assume the suspended powers of the mayor and city council, and will take unilateral control of municipal finances, union contracts, pension systems, and more.

Feb 26, 2013

The Value of Financial Literacy (full story here)

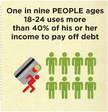

Students who learn financial literacy skills gain knowledge that will yield returns well into their future. With nearly 20% of Americans living beyond their means, education about personal finance is critical.

* Half of Americans do not maintain a budget *

* Half of Americans do not maintain a budget *

Feb 25, 2013

The high cost of putting on the Oscars ceremony (full story here)

Since we like money and numbers so much, here are some interesting statistics about the Oscars:

The Academy of Motion Pictures Arts and Sciences earns a reported $89.6 million from the Oscars.

ABC is charging from $1.6 million to $1.8 million for a 30-second Oscar ad.

The red carpet costs about $1.50 per square foot, or about $25,000.

Read more here.

The Academy of Motion Pictures Arts and Sciences earns a reported $89.6 million from the Oscars.

ABC is charging from $1.6 million to $1.8 million for a 30-second Oscar ad.

The red carpet costs about $1.50 per square foot, or about $25,000.

Read more here.

Feb 23, 2013

Check Out College Tax benefits for 2012 and Years Ahead (full story here)

The Internal Revenue Service today reminded parents and students that now is a good time to see if they qualify for either of two college education tax credits or any of several other education-related tax benefits.

In general, the American opportunity tax credit, lifetime learning credit and tuition and fees deduction are available to taxpayers who pay qualifying expenses for an eligible student. Eligible students include the primary taxpayer, the taxpayer’s spouse or a dependent of the taxpayer.

Read more here.

In general, the American opportunity tax credit, lifetime learning credit and tuition and fees deduction are available to taxpayers who pay qualifying expenses for an eligible student. Eligible students include the primary taxpayer, the taxpayer’s spouse or a dependent of the taxpayer.

Read more here.

Feb 22, 2013

You can use net operating losses to lower your taxes in future years

Did you know that you can use net operating losses to lower your taxes in future years?

Damages and losses from fires, earthquakes, floods, storms, vandalism are deductible only during the taxable year that the damage or loss occurred.

DON'T MISS THIS OPPORTUNITY!

For more details call us at 248-325-7156!

Damages and losses from fires, earthquakes, floods, storms, vandalism are deductible only during the taxable year that the damage or loss occurred.

DON'T MISS THIS OPPORTUNITY!

For more details call us at 248-325-7156!

Feb 15, 2013

Three financial goals to accomplish before saying "I DO" (full story here)

Whether you have found the perfect life mate or not, there are three financial goals that everyone should work on before they walk down the aisle. Marriage is truly a blessing, but finances are the number one item couples argue about. To keep your marriage sailing smoothly and to give yourself a good start financially, work toward these three goals before saying, “I Do”. Read more here.

Feb 12, 2013

MyMoney.Gov

MyMoney.gov is the U.S. government's website dedicated to teaching all Americans the basics about financial education. Whether you are buying a home, balancing your checkbook, or investing in your 401(k), the resources on MyMoney.gov can help you maximize your financial decisions. Throughout the site, you will find important information from 20 Federal agencies and Bureaus designed to help you make smart financial choices.

Feb 10, 2013

Top 10 ways to teach your children about money (full story here)

If you want your children to grow up to be financially independent adults so that when they graduate from college, you also graduate from providing their support, here are our top three choices:

1. Don’t buy them everything they want.

2. Provide a modest allowance.

3. Open a savings account around age 10.

Read more here.

1. Don’t buy them everything they want.

2. Provide a modest allowance.

3. Open a savings account around age 10.

Read more here.

Feb 9, 2013

Missing your W-2? Here's what to do! (full story here)

If you have not received your W-2, follow these three steps:

1. Contact your employer first. Ask your employer – or former employer – to send your W-2 if it has not already been sent. Make sure your employer has your correct address.

2. Contact the IRS. After February 14, you may call the IRS at 800-829-1040 if you have not yet received your W-2. Be prepared to provide your name, address, Social Security number and phone number. You should also have the following information when you call: Your employer’s name, address and phone number; Your employment dates; An estimate of your wages and federal income tax withheld in 2012, based upon your final pay stub or leave-and-earnings statement, if available.

3. File your return on time. You should still file your tax return on or before April 15, 2013, even if you have not yet received your W-2. File Form 4852, Substitute for Form W-2, Wage and Tax Statement, in place of the W-2. Use the form to estimate your income and withholding taxes as accurately as possible. The IRS may delay processing your return while it verifies your information.

1. Contact your employer first. Ask your employer – or former employer – to send your W-2 if it has not already been sent. Make sure your employer has your correct address.

2. Contact the IRS. After February 14, you may call the IRS at 800-829-1040 if you have not yet received your W-2. Be prepared to provide your name, address, Social Security number and phone number. You should also have the following information when you call: Your employer’s name, address and phone number; Your employment dates; An estimate of your wages and federal income tax withheld in 2012, based upon your final pay stub or leave-and-earnings statement, if available.

3. File your return on time. You should still file your tax return on or before April 15, 2013, even if you have not yet received your W-2. File Form 4852, Substitute for Form W-2, Wage and Tax Statement, in place of the W-2. Use the form to estimate your income and withholding taxes as accurately as possible. The IRS may delay processing your return while it verifies your information.

Feb 8, 2013

IRS to accept tax returns with education credits and depreciation next week

(full story here)

The Internal Revenue Service announced today that taxpayers will be able to start filing two major tax forms next week covering education credits and depreciation.

Starting Sunday, Feb. 10, the IRS will start processing tax returns that contain Form 4562, Depreciation and Amortization. And on Thursday, Feb. 14, the IRS plans to start processing Form 8863, Education Credits.

This step clears the way for almost all taxpayers to start filing their tax returns for 2012.

Starting Sunday, Feb. 10, the IRS will start processing tax returns that contain Form 4562, Depreciation and Amortization. And on Thursday, Feb. 14, the IRS plans to start processing Form 8863, Education Credits.

This step clears the way for almost all taxpayers to start filing their tax returns for 2012.

Feb 5, 2013

Understanding Income Taxes In 5 Minutes

1. Income

2. Deductions for AGI

3. Deductions from AGI

4. Exemptions

5. Income Tax

6. Credits

7. Other Taxes

2. Deductions for AGI

3. Deductions from AGI

4. Exemptions

5. Income Tax

6. Credits

7. Other Taxes

Feb 2, 2013

Where Your Income Tax Money Really Goes (full story here)

Click to enlarge

You want to find out what really happens with our hard earned money that we pay every year in income taxes?

According to this study, about half of the funds are going towards the military and almost another half funds social programs, like Social Security.

Only about 14% is used to run the Government.

Click here for details.

According to this study, about half of the funds are going towards the military and almost another half funds social programs, like Social Security.

Only about 14% is used to run the Government.

Click here for details.

Jan 29, 2013

Do you owe taxes to IRS? Check out the new Offer in Compromise guidelines!

(full story here)

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability, or doing so creates a financial hardship.

Jan 25, 2013

In tax year 2011, over 27 million eligible workers and families received nearly $62 billion total in Earned Income Tax Credit (full story here)

The Internal Revenue Service launched the Earned Income Tax Credit Awareness Day outreach campaign today, aimed at helping millions of Americans who earned $50,270 or less take advantage of the Earned Income Tax Credit (EITC).

The EITC varies by income, family size and filing status. The average EITC amount last year was around $2,200. People can see if they qualify by visiting IRS.gov and answering a few questions using the EITC Assistant.

The EITC varies by income, family size and filing status. The average EITC amount last year was around $2,200. People can see if they qualify by visiting IRS.gov and answering a few questions using the EITC Assistant.

Jan 24, 2013

IRS Responds to District Court Decision (full story here)

Over a year ago, three independent tax preparers along with the Institute of Justice, filed suit against the Internal Revenue Service claiming the new registered tax return preparer regulations were “beyond the powers” of the IRS and a substantial threat to the plaintiffs’ livelihoods.

On Friday, January 18, 2013, the United States District Court for the District of Columbia handed down a decision granting permanent injunction relief to the plaintiffs

On Friday, January 18, 2013, the United States District Court for the District of Columbia handed down a decision granting permanent injunction relief to the plaintiffs

Jan 23, 2013

6 Tips To Get Organized For Income Taxes (full story here)

Ready for tax season? Make the process smooth this year by getting everything together now.

1. Get your numbers in order

2. Tally your income

3. Find last year’s returns

4. Line up deductions

5. Pile on the contributions

6. Plan for your refund

1. Get your numbers in order

2. Tally your income

3. Find last year’s returns

4. Line up deductions

5. Pile on the contributions

6. Plan for your refund

Jan 16, 2013

Simplified option for claiming home office deduction (full story here)

Owners of home-based businesses and home-based workers may use the new option to figure the deduction for business use of the home on 2013 tax returns.

The new optional deduction, capped at $1,500 per year based on $5 a square foot for up to 300 square feet, will reduce the paperwork and record keeping burden on small businesses by an estimated 1.6 million hours annually.

The new optional deduction, capped at $1,500 per year based on $5 a square foot for up to 300 square feet, will reduce the paperwork and record keeping burden on small businesses by an estimated 1.6 million hours annually.

Jan 14, 2013

2013 tax calendar for small businesses and self-employed (full story here)

Online Calendar: View due dates and actions for each month. You can see all events or filter them by monthly depositor, semiweekly depositor, excise, or general event types.

Desktop Calendar Tool: The IRS Calendar Connector provides access to Important Tax Dates for Small Businesses right from your desktop, even when you're offline. As new events are added, they will be automatically updated via the desktop tool.

Desktop Calendar Tool: The IRS Calendar Connector provides access to Important Tax Dates for Small Businesses right from your desktop, even when you're offline. As new events are added, they will be automatically updated via the desktop tool.

Jan 9, 2013

IRS Plans Jan. 30 Tax Season Opening For 1040 Filers (full story here)

Following the January tax law changes made by Congress under the American Taxpayer Relief Act (ATRA), the Internal Revenue Service announced today it plans to open the 2013 filing season and begin processing individual income tax returns on Jan. 30.

There are several forms affected by the late legislation that require more extensive programming and testing of IRS systems. The IRS hopes to begin accepting tax returns including these tax forms between late February and into March; a specific date will be announced in the near future (full list here).

There are several forms affected by the late legislation that require more extensive programming and testing of IRS systems. The IRS hopes to begin accepting tax returns including these tax forms between late February and into March; a specific date will be announced in the near future (full list here).

Dec 22, 2013

IRS states refunds will be delayed (full story here)

“When can I expect to receive my refund?” is the most frequently asked question of a tax preparer. This year your tax preparer may not be able to give you an answer.

The IRS states “In a change from previous filing seasons, taxpayers won’t get an estimated refund date right away.” From a customer service standpoint, this presents a problem in managing your clients expectations. The IRS states that “most taxpayers will have their refunds within 23 days”, a significant delay from recent years.

The IRS states “In a change from previous filing seasons, taxpayers won’t get an estimated refund date right away.” From a customer service standpoint, this presents a problem in managing your clients expectations. The IRS states that “most taxpayers will have their refunds within 23 days”, a significant delay from recent years.